InvestOn

Client Relationship Summary: Learn more about the services we provide to retail investors.

Invest your money. Not your time.

With InvestOn, you don't have to meet with advisors or continually adjust your investments to get a personalized portfolio based on your specific goals. Just open an account and we'll do the work.

-

Easy online set-up

Open an InvestOn account any time you like, right from your computer or smartphone. It can take as little as 15 minutes.

-

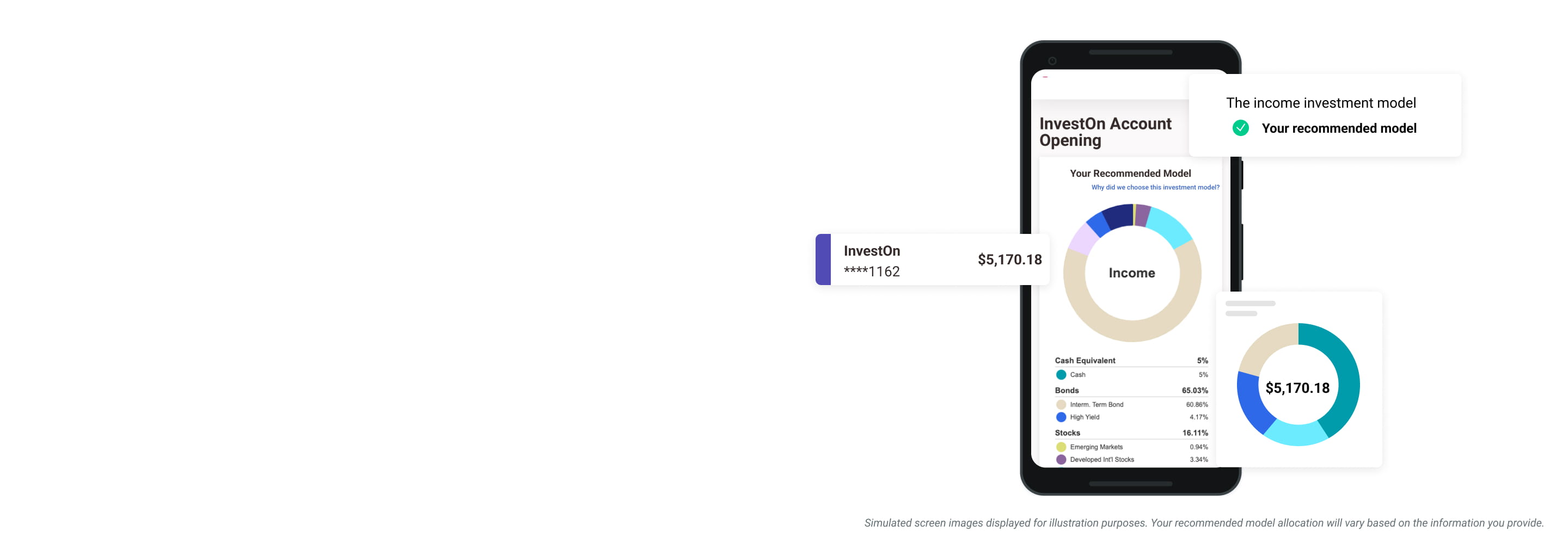

Get your recommended investment strategy

After a few simple questions, we'll suggest an asset allocation model to help you reach your identified financial goals.

-

Ongoing "behind-the-scenes" investing

The investment selection aspect of your model will be professionally managed by a team of BOK Financial investment professionals.

What are you dreaming of?

InvestOn makes it easy to stop dreaming and start investing.

Investing for retirement? Choose a Traditional IRA or Roth IRA.*

Investing for something else? Choose an Individual or Joint Account.

-

$1,000** is the minimum initial investment to get started.

-

With a low program fee*** of 0.7%, you can be sure your investments stay with you.

Managed by professionals, not robots

With InvestOn, you don't have to choose your investments or worry about asset allocation. BOK Financial investment professionals manage your selected model.

Why wait? Starting is easy as 1, 2, 3.

We're here for you

Whether you have questions about opening an InvestOn account, need assistance with an existing account, or wish to discuss more complex investing matters, our licensed financial advisors are ready to assist.

Financial advisors are available Monday through Friday from 9 a.m. - 5 p.m. CT

Call: 833-714-1780

Frequently Asked Questions

-

InvestOn is a model-based asset allocation program that systematically rebalances client accounts to maintain target asset allocations and remove the emotion from investing. Your recommended asset allocation model will be based on the information you have provided us, including, but not limited, to your account risk tolerance and account time horizon.

-

InvestOn makes investing easier. You don’t have to choose your own investments or worry about asset allocation. InvestOn is most appropriate for those who want a simple, “hands-off” approach to managing their investments.

-

The investment selection aspect of InvestOn is professionally managed by BOKF, NA’s Strategic Investment Advisors (“SIA”) group. SIA provides the research and analytics that build the foundation for investment services within BOK Financial†. Asset allocation research, manager selection and oversight, and market analysis conducted by the group is utilized to deliver sophisticated investment solutions for clients of BOKFA and our affiliates. SIA establishes, monitors, and updates target asset allocation models as deemed necessary.

†BOK Financial® is a trademark of BOKF, NA. Member FDIC. You may know them as BOK Financial, Bank of Oklahoma, Bank of Texas, or Bank of Albuquerque, depending on where you live.

-

Financial advisors are available Monday-Friday 9 a.m.-5 p.m. CT

Phone Number: 833-714-1780

Email: InvestOn@bokf.com -

The minimum to open an account is $1,000*. No minimum monthly deposit is required.

-

We offer four types of InvestOn accounts: individual, joint, traditional IRA, and Roth IRA.

Individual or joint taxable accounts: Any interest or dividends you earn in a taxable account are subject to taxes in the year you receive them. Additionally, you may also be subject to taxes if you realize capital gains when you sell an investment. Unlike an IRA (Individual Retirement Account), there are no limits to how much can be contributed to a taxable account and no restrictions on when an individual can withdraw money.

Traditional IRA: A traditional IRA (Individual Retirement Account) is a tax-deferred retirement savings account. You pay taxes on your money only when you make withdrawals in retirement. That means all of your dividends, interest payments and capital gains can compound each year without being decreased by taxes, which may help your IRA to grow faster than a taxable account. This can be an attractive option for people who expect their tax bracket in retirement to be lower than their current tax bracket.

THE PROS- You’re in control: You decide where to open your IRA and you choose the investment options within your IRA. The options you have available to you will depend on where you open your account, but you can easily choose and change the asset allocation within your IRA.

- More options: Generally, IRA investors get more investment options than 401(k) investors.

- No income limits: Anyone with earned income (no matter how much or how little) may contribute to a traditional IRA.

- Not employer dependent: Since IRAs are not employer-sponsored, it doesn’t matter where you work. IRAs are a popular choice for full-time and part-time workers with no 401(k) option at work.

- Lower contribution maximum: The maximum you can contribute to a traditional IRA in 2024 is $7,000 ($8,000 if you’re age 50 or older).

- Low contribution rate: IRAs have a low contribution rate, which may not be enough for those beginning an IRA retirement plan later in life.

- Contributions aren’t always deductible: If you have access to a workplace retirement account such as a 401(k), contributions to an IRA may not be deductible. The rules are complicated and depend on your workplace, your income, and your spouse’s workplace and income. An advisor can walk you through the specifics.

Roth IRA: A Roth IRA is a tax-advantaged individual retirement account. Your contributions are made after tax, which means there’s no initial tax benefit. But that money and your investment earnings grow tax-free, meaning there’s no income tax on Roth IRA withdrawals in retirement. This can be an attractive option for people who expect their retirement tax bracket to be equal to or higher than their current tax bracket.

THE PROS- More options: Like a traditional IRA, Roth IRAs tend to offer more investment options than 401(k) plans.

- Tax-free compounding: Qualified withdrawals from a Roth IRA are 100% tax-free, no matter how much your account has grown. This basically lets you “lock-in” your current tax rate (which is great if you expect your income to rise in the future).

- No maximum age to contribute: You can contribute to a Roth IRA at any age.

- No required minimum distributions: Traditional IRAs require minimum distributions based on the IRA owner's life expectancy be taken after the owner turns 73 (age 70 ½ if you attained age 70 ½ before 2020). Roth IRAs don't have any minimum distribution requirements during the account owner's lifetime (which can make them an excellent estate-planning tool).

- Income limits: Everyone can contribute to a traditional IRA, regardless of income. Roth IRAs, however, have limits on the amount of income you can make and still contribute.

- No immediate tax deduction: While traditional IRA contributions may be deductible in the tax year in which they were made, Roth contributions are not.

- No employer match: Your Roth IRA is independent of your job, so your employer won’t match any contributions.

-

Through the online access platform made available by our banking affiliate, BOK Financial†, you are able to log in and deposit money into your InvestOn account from a linked banking account, or a financial advisor can assist you.

If you’d like to withdraw funds from your InvestOn account, a financial advisor can assist you.

†BOK Financial® is a trademark of BOKF, NA. Member FDIC. You may know them as BOK Financial, Bank of Oklahoma, Bank of Texas, or Bank of Albuquerque, depending on where you live.

-

The initial universe for investments is the Morningstar mutual funds and exchange traded funds database, with the universe limited to include those fund families that currently have a selling agreement with BOKFS (BOK Financial Securities) or an established business relationship with BOKFA. We may pursue selling agreements with fund companies that meet our criteria but for which we do not yet have a business relationship.

Our screening process checks such quantitative areas as the fund’s history, manager tenure, amount of assets under management, ranking compared to other funds in their peer category, and the performance of the fund as compared to others in their peer category. Qualitative areas we may review include the investment philosophy of the fund and any legal or compliance issues they may have had in the past.

-

- Annual fee of 0.70% charged monthly (sometimes referred to as 70 basis points).

- For IRAs only: Annual IRA maintenance fee of $55.

- For further information on fees and compensation including costs associated with owning mutual funds, please reference the BOK Financial Advisors InvestOn Wrap Fee Program Brochure.